Healthcare Marketing Budget Benchmarks

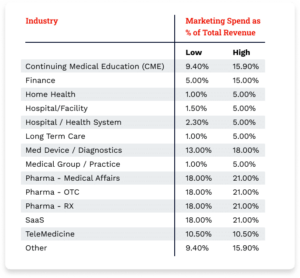

Healthcare industry marketing spend benchmarks range significantly. For example, our chart below highlights medical practices typically spend anywhere from 1-5% of their annual revenue on marketing efforts, while pharma companies spend 18-21%. Marketing budget averages can fluctuate depending on various factors and specific industry conditions. Another element that can impact marketing costs is attracting customers directly rather than relying on a physician referral system. Newer companies may need a better brand reputation to rely on to bring in more patients.

The following chart outlines lower and higher marketing budget percentage allocations based on total revenue for each significant healthcare industry.

To better understand these budget allocation percentages, let’s dive into why each industry reflects such diverse marketing benchmarks.

Competitive Healthcare Industries

Continuing Medical Education (CME): CME programs [5] are in high demand, as HCPs must complete certain credits. Because of this enormous potential customer base and dense competition among CME providers to gain brand recognition, CME providers must invest heavily in marketing efforts like email, paid search, social media, display ads, and direct mail.

Medical Device/Diagnostics: The medical device industry[6] is incredibly competitive, with massive companies like Medtronic and Stryker vying for market share. Medical device companies are increasingly spending more on digital marketing and HCP outreach to build brand awareness, differentiate their products, and reach potential customers.

Pharmaceuticals: The highly regulated and competitive nature of the pharmaceutical industry[7] presents significant marketing challenges that drive companies to invest heavily in marketing efforts to differentiate their products, reach HCPs, patients, and caregivers, demonstrate ROI, and adapt to industry changes.

SaaS: The highly competitive nature of the Software as a Service (SaaS) industry[8] forces SaaS companies to invest heavily in digital marketing tactics, data-driven decision-making, and an integrated approach to outbound and inbound marketing efforts to acquire and retain customers.

Telemedicine: Large established healthcare providers and newer telemedicine-focused companies[9] compete for market share, requiring telemedicine companies to invest significantly in marketing to stand apart and reach potential customers. Also, the telemedicine market is still relatively new, so companies must invest in marketing to educate consumers and demonstrate value to overcome barriers to adoption.

Less Competitive Healthcare Industries

Hospital and Medical Practices: Hospital and medical practice marketing budgets[10] can swing depending on the specialty and location of the organization. Due to patient demand, more competitive industries, for instance, would include family medicine and cardiology, particularly in densely populated areas. Therefore, companies in these fields must invest more in marketing to differentiate themselves. On the other hand, companies in more niche, specialized fields like podiatry or those in more rural areas would face less competition and, therefore, have to spend less on marketing efforts.

Home Health and Long-Term Care Centers: The home health and long-term care center industries are competitive due to growing patient demand, but companies, on average, are only spending 1-2%[11] of their total revenue on marketing efforts. This leaves plenty of opportunity for companies to invest more in marketing and lead generation to stand apart from the competition.

Finance: The healthcare finance solutions market[12] is less competitive due to high regulatory barriers, the need for specialized expertise, customer loyalty, and market segmentation. These factors allow companies in this industry to take a more measured, educational, and personalized approach to marketing compared to more competitive industries.

Aligning Healthcare Marketing Budgets with Growth Ambitions

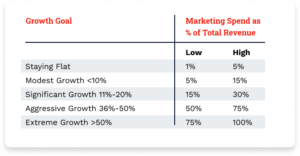

Growth goals[13] are a critical factor influencing how healthcare organizations allocate their marketing budgets. A marketing budget should align with the organization’s growth objectives, whether increasing website traffic, generating more leads, or boosting sales.

As stated, companies aiming to maintain current growth[5] should allocate 1-5% of their total revenue towards marketing efforts. On the other hand, steady growth requires roughly 8-10%, while aggressive growth demands approximately 10-14%.

Other industry benchmarks dictate that 5-15 % signifies modest growth, 11-20% signifies significant growth, 36-50% signifies aggressive growth, and any percentage over 50% of budget allocation is generally considered an extreme growth range.

The Impact of Organizational Age on Healthcare Marketing Budgets

Healthcare marketing strategies and budget allocations vary significantly based on a company’s age and size, reflecting distinct priorities at each stage of development. Here’s a breakdown of how companies at different maturity levels typically invest their marketing dollars:

Startups and New Companies (Under 5 Years Old)

Average Marketing Budget: $4.3 million[14]

Younger companies prioritize digital marketing tactics, including social media, email/direct mail, and search ads, to swiftly establish their market presence. They strongly emphasize operational efficiencies, utilizing tools like patient scheduling software to enhance marketing capabilities and gain momentum quickly. Additionally, demonstrating ROI and accurately measuring marketing impact is fundamental for these companies, as these metrics are crucial to justify the expenditures and continuously refine their marketing strategies.

Established Companies (5-20 Years Old)

Average Marketing Budget: $7.6 million[14]

Established companies are witnessing a significant evolution in their marketing strategies, with a noticeable shift towards digital channels where digital ad spending now exceeds traditional avenues like TV. These companies are enhancing integration between their marketing and technology teams to build a seamless customer experience across multiple channels. Additionally, they strongly emphasize analytics and attribution to measure marketing effectiveness, focusing on enhancing the overall patient experience. This comprehensive approach supports their goals of maintaining competitiveness and adapting to changing consumer behaviors.

Mature Companies (20+ Years Old)

Average Marketing Budget: $11.4 million (for companies over $500 million in revenue)[14]

Mature companies with substantial revenues—often exceeding $500 million—allocate an average marketing budget of $11.4 million, allowing them to make significant investments in critical areas such as physician outreach, market research, and sales aids. These companies extensively leverage data and advanced analytics to personalize marketing strategies and enhance consumer engagement. Their long-term strategic focus is on developing mature marketing capabilities, with the ultimate goal of building enduring consumer relationships. This strategic approach optimizes current operations and secures a sustainable competitive advantage in the healthcare market.

Legacy Companies (50+ Years Old)

Average Marketing Budget: $9.3 million (for large pharmaceutical companies)[14]

Legacy companies allocate significant funds towards digital transformation, focusing heavily on integrating sophisticated marketing technology stacks to stay ahead in a rapidly evolving marketplace. These organizations prioritize innovation and form strategic partnerships, often leading to the creation of cutting-edge digital therapeutic solutions. Furthermore, they employ advanced analytics and sophisticated attribution methods to continually refine and optimize their marketing efforts, ensuring they maintain a competitive edge and drive meaningful engagement with their consumer base.

Improve Your Healthcare Marketing Performance With Health Union

Determining your marketing spend and understanding the competitive landscape is crucial, whether you are a healthcare marketing agency, pharmaceutical company, medical device manufacturer, or medical practice. By aligning your marketing investments with broader business goals—whether increasing brand awareness, generating new patient leads, or boosting website traffic—Health Union can collaborate with you to develop a customized strategy that meets and exceeds your marketing needs.

Learn more about how Health Union is activating the largest and most unique HCP data in healthcare: health-union.com/human-side-of-data/#HCP

Sources

- Leventhal, R. (2023, March 13). The digital healthcare consumer 2023: What providers and marketers need to know about the digital patient journey. Emarketer. https://www.emarketer.com/content/digital-healthcare-consumer-2023/

- New survey from BIA and SalesFuel reveals $12 billion projected in 2024 for local healthcare advertising. (2023, December 7). BIA Advisory Services. https://www.bia.com/healthcare-marketers-survey-results-and-analysis/

- Mitton, K. (2023, December 1). 2024 trends for healthcare and pharmaceutical marketers. Basis Technologies. https://basis.com/blog/2024-trends-for-healthcare-and-pharmaceutical-marketers

- Andersen, D. (2024, February 6). 42 Statistics healthcare marketers need to know in 2024. Invoca. https://www.invoca.com/blog/healthcare-marketing-statistics

- How much should healthcare organizations spend on marketing? (n.d.). Evolve. https://ehmresults.com/how-much-should-healthcare-organizations-spend-on-marketing/

- Breuer, R., Guenther, E., Motiwala, R., & Zerbi, C. (2021, September 24). The rise of digital marketing in medtech. McKinsey & Company. https://www.mckinsey.com/industries/life-sciences/our-insights/the-rise-of-digital-marketing-in-medtech

- Kirksey, C. (2024, February 12). What percentage of revenue should be spent on marketing? Direction. https://direction.com/percentage-of-revenue-marketing-spend/

- Perry, N. (2023, August 31). 2023 Spending benchmarks for private B2B SaaS companies. SaaS Capital. https://www.saas-capital.com/blog-posts/spending-benchmarks-for-private-b2b-saas-companies/

- How much should you spend on marketing? (2024, February 15). The AD Leaf Marketing & Advertising Firm, LLC. https://www.theadleaf.com/how-much-should-you-spend-on-marketing

- Gandolf, S. (2022, July 12). Healthcare marketing and medical advertising for doctors, hospitals, healthcare networks & pharmaceuticals. Healthcare Success. https://healthcaresuccess.com/blog/healthcare-marketing/healthcare-marketing-budget.html

- Olivo, F. (n.d.). How much do home care agencies spend on marketing? Sagapixel. https://sagapixel.com/marketing/how-much-do-home-care-agencies-spend-on-marketing/#:~:text=competitors%20are%20spending.-,The%20Most%20Common%20Monthly%20Advertising%20Budget%20We%20See%20is%20%24500,k%20to%20%24100k%20a%20month.

- Lake, R. (2024, March 4). How much financial advisors should spend on marketing. SmartAsset. https://smartasset.com/advisor-resources/financial-advisor-marketing-budget

- Ogg, A. (2023, October 27). 8 Health tech marketing budget allocation best practices. ClarityQuest. https://www.clarityqst.com/blog/marketing-budget-allocation-best-practices/

- Mahoney, S. (2023, March 7). The 2023 healthcare marketers trend report: A trim off the top. MM+M. https://www.mmm-online.com/home/channel/features/healthcare-marketers-trend-report-2023-a-trim-off-the-top/